The global workforce is more connected than ever. Businesses in the U.S. regularly engage foreign contractors, freelancers, and companies for their services. But hiring internationally comes with tax obligations. To ensure compliance, U.S. businesses must collect the W-8BEN form from non-U.S. individuals and the W-8BEN-E form from foreign entities. Failing to do so could result in an automatic 30% tax withholding—a costly oversight.

Foley & Lardner LLP reported that in 2023, the total value of cross-border payments was $190.1 trillion, with projections to reach $290.2 trillion by 2030. Understanding when and how to collect these forms helps businesses stay compliant and avoid unnecessary financial penalties. Understanding when and how to collect these forms helps businesses stay compliant and avoid unnecessary financial penalties.

Key Takeaways

- A Critical Tool for Tax Compliance: The W-8BEN form is an essential IRS document that non-U.S. individuals must provide to U.S. companies. Its primary purpose is to certify their foreign status, which is necessary for the company to comply with U.S. tax withholding regulations.

- Prevents Automatic 30% Tax Withholding: The most immediate and important function of the W-8BEN form is to prevent a U.S. company from being legally required to withhold a flat 30% tax on payments made to a foreign individual.

- Used to Claim Tax Treaty Benefits: The form allows individuals from countries that have a tax treaty with the U.S. (over 60 countries) to claim reduced or zero tax withholding on their U.S.-sourced income, ensuring they are not over-taxed.

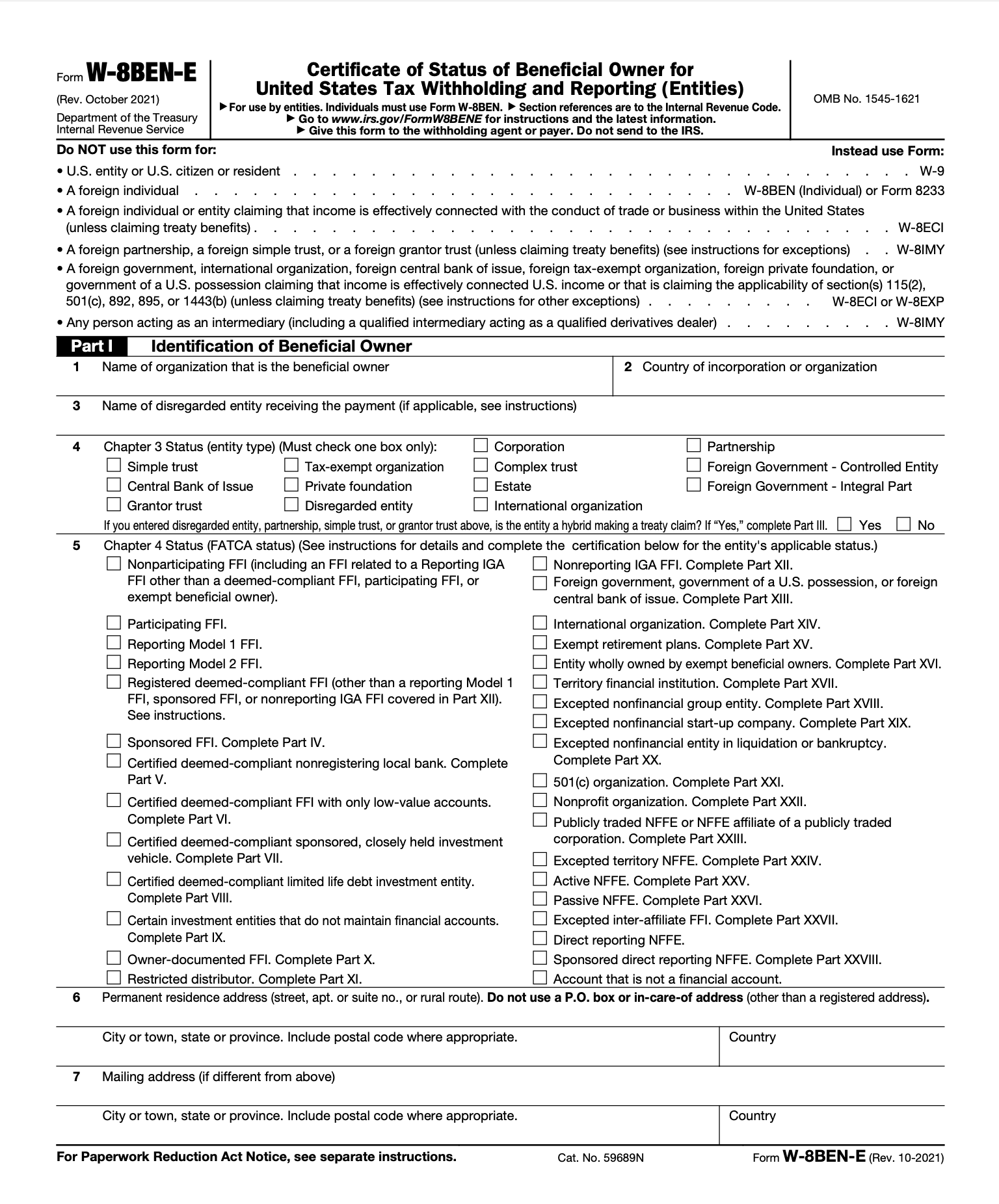

- W-8BEN is for Individuals, W-8BEN-E is for Businesses: It is crucial to use the correct form. The W-8BEN is a simpler form used exclusively by foreign individuals (like freelancers or contractors). The W-8BEN-E is a more complex version used by foreign business entities (such as a foreign corporation or partnership).

What Is a W-8BEN Form?

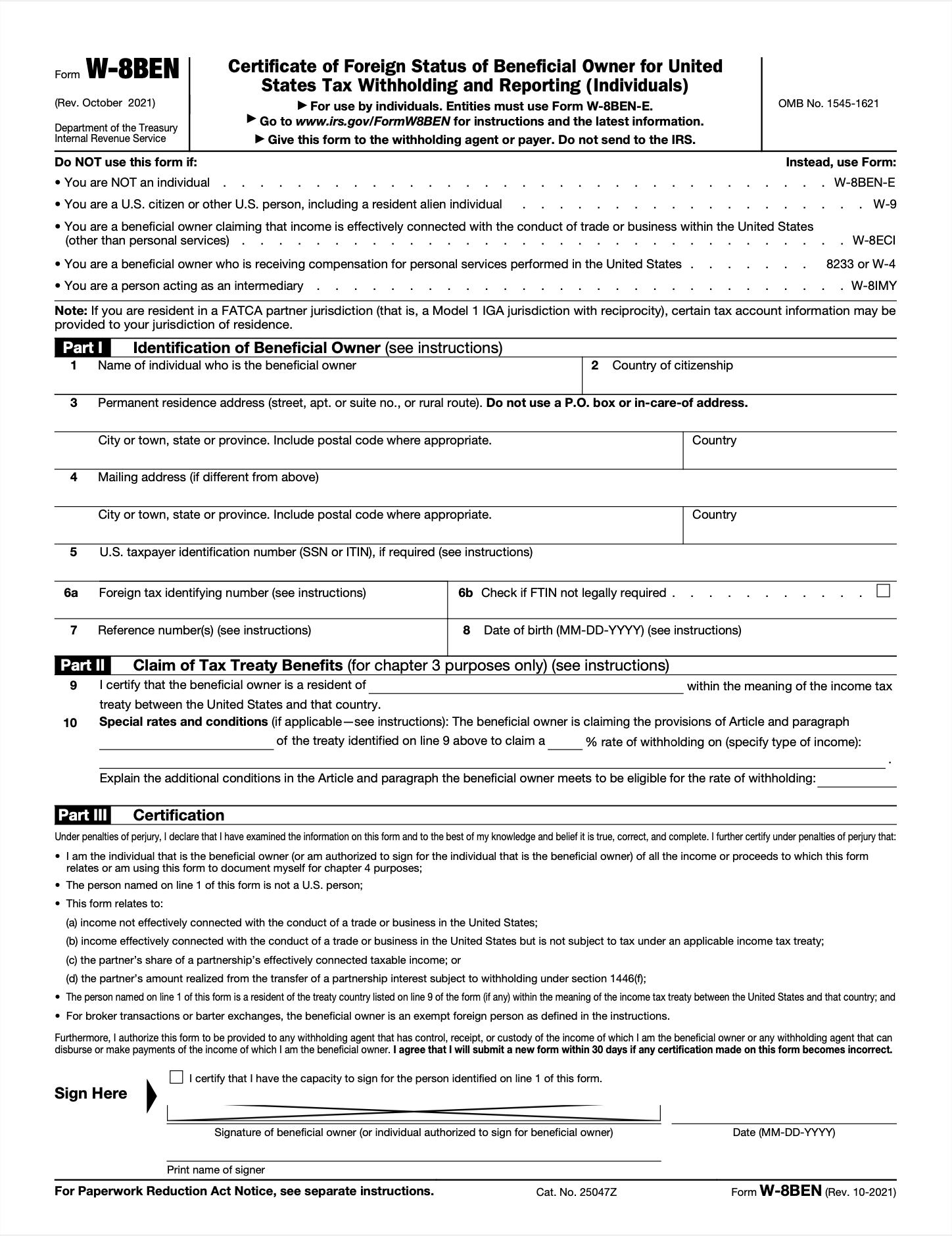

The W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting) is an IRS form used by non-U.S. individuals to certify their foreign status and claim tax treaty benefits. Its primary purposes include:

- Preventing unnecessary tax withholding on U.S.-sourced income. Without the W-8BEN form, businesses are required to withhold a standard 30% tax on payments made to foreign individuals. This form ensures that eligible recipients can claim exemptions or reduced withholding rates based on tax treaties, preventing unnecessary financial deductions.

- Confirming the payee is a foreign individual, not a U.S. taxpayer. The form acts as an official declaration that the recipient is not a U.S. resident for tax purposes, helping businesses correctly categorize payments and comply with IRS regulations.

- Applying tax treaty benefits that may reduce or eliminate withholding tax. According to PwC Global Tax Insights, the U.S. has tax treaties with over 60 countries, which can significantly lower withholding rates for eligible individuals. The W-8BEN form provides a means for eligible individuals to claim these benefits, ensuring they are taxed fairly based on international agreements.

W-8BEN vs. W-8BEN-E

In certain cases, seeking advice from a tax or payroll specialist may be necessary. But as a general rule, here’s the uses of each type of W-8BEN.

- W-8BEN: Used by individuals who are non-U.S. persons. This form is designed for foreign independent contractors, freelancers, and other individuals receiving U.S.-sourced income.

- W-8BEN-E: Used by foreign businesses or entities receiving U.S.-sourced income. Companies, organizations, and foreign corporations must use the W-8BEN-E form to declare their foreign status and claim treaty benefits where applicable.

Why Do You Need to Collect a W-8BEN?

- Who needs to provide a W-8BEN?

- Non-U.S. freelancers, independent contractors, and remote employees providing services to a U.S. business. Any foreign individual performing work for a U.S. company should submit this form to avoid excessive withholding and to establish their tax status.

- Foreign businesses receiving U.S.-sourced payments (they use the W-8BEN-E form). International corporations that receive payments from U.S.-based entities must complete this form to ensure proper tax classification and withholding rates.

- IRS requirements and compliance:

- The IRS mandates that U.S. businesses withhold 30% tax from foreign payments if a W-8BEN is not collected. This means that, without the form, businesses must deduct a significant portion of the payment as tax before transferring the remaining balance to the recipient.

- Collecting the form ensures businesses apply the correct tax withholding rate. By having the W-8BEN on file, companies can legally reduce or remove withholding tax based on applicable tax treaties, reducing financial burdens for both parties.

- Tax treaty benefits:

- The W-8BEN form allows individuals to claim reduced tax rates if a treaty exists between the U.S. and their country. Many tax treaties specify that certain types of income, such as royalties or consulting fees, qualify for lower withholding rates, and this form serves as proof of eligibility. Learn more about outsourcing solutions for businesses to optimize international compliance.

When and How to Collect a W-8BEN Form

- When to request it:

- Before issuing the first payment to a foreign contractor or business. It is crucial to collect the form at the outset of any engagement to ensure tax compliance and avoid any potential financial discrepancies.

- When working with international freelancers, vendors, or remote employees. Any business engaging foreign talent or suppliers should request this form upfront as part of their onboarding or vendor setup process.

- How to collect it:

- Provide the contractor a W-8BEN PDF link from the IRS website. Ensure they are directed to the official form and instructions to avoid errors or outdated versions.

- Ensure all required fields are completed before accepting the form. Common mistakes include missing tax identification numbers or incorrect treaty claims, which can delay processing and tax calculations.

- Store the form securely for tax records (but do not send it to the IRS). Businesses are required to keep these forms on file for compliance purposes but do not submit them directly to the IRS.

Where to Find the W-8BEN Form

- The form is available for free on the IRS website:

- Businesses should ensure they use the latest version to comply with the most current tax regulations.

What Information Is Required on a W-8BEN Form?

To complete a W-8BEN, the following details are required:

- Personal details: Name, country of citizenship, address. These details establish the contractor’s identity and verify their non-U.S. status.

- Tax Identification Number (TIN): U.S. or foreign TIN, if applicable. This is crucial for ensuring the IRS recognizes the individual’s tax obligations in their home country.

- Tax treaty claim: If applicable, the contractor must list their country and claim benefits. This section determines whether the individual is eligible for reduced withholding rates under an existing U.S. tax treaty.

- Certification and signature: The individual must confirm their foreign status. Signing the form legally affirms the accuracy of the provided information.

Common Mistakes and How to Avoid Them

- Failing to collect the form before payment → Could result in automatic 30% withholding, unnecessarily increasing costs for contractors and making the business less attractive to foreign talent.

- Incorrect or incomplete information → Leads to delays in processing payments, often requiring the contractor to resubmit the form and causing administrative headaches.

- Using the wrong form → W-8BEN for individuals, W-8BEN-E for businesses. Ensuring the correct form is used prevents compliance issues and helps maintain accurate tax records.

Final Thoughts

For businesses hiring international talent, collecting the right tax forms is essential. The W-8BEN form ensures compliance, prevents over-withholding, and allows tax treaty benefits where applicable. Importantly, businesses do not submit these forms to the IRS—they simply keep them on record. If unsure about tax obligations, consulting a tax expert is always a smart move. Learn more about outsourcing trends and the benefits of offshore staffing to streamline your global hiring process.

Frequently Asked Questions

It is an IRS form titled “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.” A non-U.S. individual (like a foreign freelancer or contractor) fills out this form and gives it to the U.S. company that is paying them.

The U.S. company must collect it to comply with IRS regulations. The form serves two main purposes: it provides legal proof that the contractor is a non-U.S. person, and it is used to determine the correct tax withholding rate, allowing the contractor to claim any applicable tax treaty benefits.

If the company does not have a valid W-8BEN on file, the IRS legally requires it to withhold a flat 30% tax from all payments made to that foreign contractor.

It is very simple: the W-8BEN is for individuals, and the W-8BEN-E is for entities (businesses). If you are hiring a foreign individual freelancer, they fill out the W-8BEN. If you are paying a foreign business or corporation, that entity must fill out the W-8BEN-E.

No. The W-8BEN form is not sent to the IRS. The U.S. company that is making the payments is simply required to collect the form from the contractor and keep it securely on file for their own records in case of an audit.